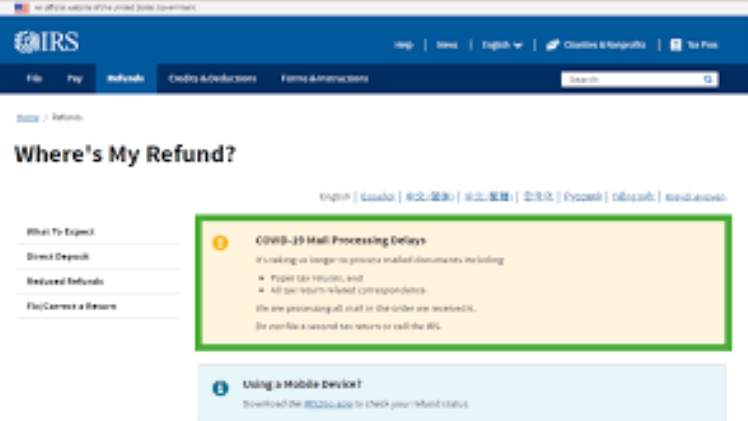

If you’re wondering why you haven’t received your tax refund yet, you’re not alone. According to the IRS, more than ten million 2021 tax returns are still unprocessed. The vast majority of these are paper-filed returns. In July, the agency reported that a backlog of 10.2 million 2021 individual returns still awaited processing, with an estimated 1.8 million requiring special handling. Currently, there are 8.4 million 2021 paper 1040s awaiting processing and review, and the process could take four months or more.

There are several ways to contact the IRS about a delayed refund. The Taxpayer Advocate Service can help you, but most taxpayers won’t find success by contacting their congressman. You can also try to contact the IRS’s customer service center. However, the success of this method will depend on how responsive the aides are.

In most cases, taxpayers’ refunds will arrive within three weeks, but that’s not always the case. The reason for this delay is the fact that the IRS is behind in processing returns. Those who filed their tax returns before the deadline have been waiting on average more than 45 days to receive their money. In addition, they’re required to pay interest for every day their refund takes to be processed.

If you’ve filed a paper tax return, you can contact the IRS to check on your refund status. While they are not able to help you online, you can call the IRS’s toll-free phone line and ask about your refund. While you might not get much information, an operator may be able to help you over the phone if you have filed a 2021 paper tax return.