When you’re in a financial pinch, the last thing you want to do is wait for a long loan approval process. If you need cash quickly, finding reliable payday loan organizations may be the best option for you. However, it’s important to choose a reliable, trustworthy lender to avoid any potential scams or financial trouble.

Here are a few tips on how to find a reliable online payday lender:

1. Do your research.

There are many online payday lenders to choose from, so it’s important to do your research before settling on one. Read reviews and compare rates to find the best option for you.

2. Check licensing and regulations.

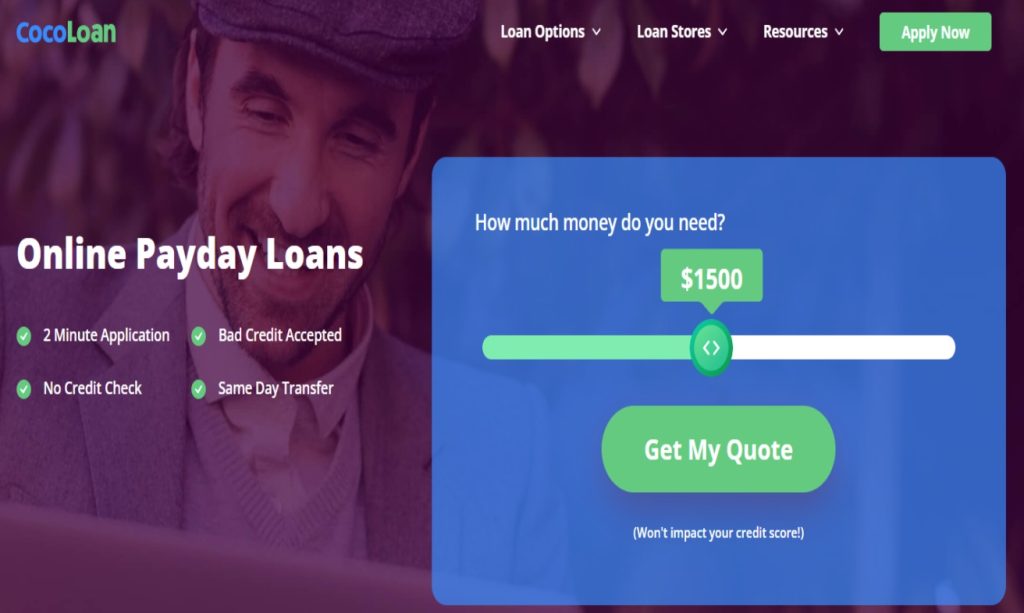

Not all payday lenders by CocoLoan are created equal. Make sure the lender you choose is licensed and regulated by the state. This will ensure that they are legitimate and comply with state laws.

3. Look for secure websites.

When submitting your personal information online, make sure you’re dealing with a secure website. Look for the padlock symbol in your web browser and the “HTTPS” in the web address. This means the website is encrypted and your information is safe.

4. Avoid high-interest rates.

One of the biggest drawbacks of payday loans is the high-interest rates. Make sure you understand the interest rates and fees before you apply.

5. Know your rights.

If you do decide to take out a payday loan, be sure to familiarize yourself with your rights as a borrower. The Consumer Financial Protection Bureau (CFPB) has a helpful guide on payday loans that outlines your rights and protections.

When choosing a payday lender, it’s important to do your research and weigh all your options. By following these tips, you can ensure you’re dealing with a reputable, reliable lender.

What Should I Look for in an Online Payday Lender?

There are a lot of payday lenders online, and it can be tough to figure out which one is right for you. Here are some things to look for:

- Check the lender’s licensing and compliance history. Make sure the lender is licensed in your state and that they have a good compliance history.

- Read the terms and conditions. Make sure you understand the terms and conditions of the loan, including the interest rate, repayment terms, and late fees.

- Check the lender’s reviews. Read reviews from other borrowers to get an idea of what the experience is like.

- Compare rates. Compare rates from different lenders to find the best deal.

- Get a loan estimate. Get a loan estimate from the lender to see how much the loan will cost.

- Check the lender’s website. Make sure the lender’s website is secure and looks professional.

- Ask the lender questions. If you have any questions, don’t hesitate to ask the lender.

Pros and Cons of Borrowing from an Online Payday Lender

When you’re in a pinch and need money fast, an online payday lender might seem like the best option. After all, they offer quick, easy loans with no credit check. But is borrowing from an online payday lender really a good idea?

Here are some pros and cons to consider:

PROS

– quick, easy loans

– no credit check

CONS

– high interest rates

– can be difficult to repay

What Do I Need to Get Approved by a Payday Lender?

When you’re in a bind and need some fast cash, a payday loan from CocoLoan can seem like a great option. But what do you need to know to get approved by a payday lender?

First, you’ll need to be 18 years or older and have a checking account and a valid ID. You’ll also need to have a steady source of income, and your monthly income should be at least 1.5 times the amount of the loan you’re requesting.

Some payday lenders may also require you to have a minimum credit score, so be sure to check with a few lenders before you apply. And finally, be sure to have the cash on hand to pay back the loan on your next payday, as these loans typically come with very high interest rates.

How Quickly Will My Online Payday Loan Be Processed?

When you’re in need of some quick cash, an online payday loan via CocoLoan can be a great option. These loans are processed quickly, and you can often have the money in your bank account in just a few days. However, you may be wondering how quickly your online payday loan will be processed. The answer depends on the lender you choose.

Some lenders process payday loans very quickly, while others may take a bit longer. It’s important to read the terms and conditions of each loan before you apply, so you know exactly how quickly your loan will be processed.

Remember, you don’t want to wait too long to get your loan processed, as you may end up losing out on the money you need. So, choose a lender from CocoLoan that is able to process loans quickly, so you can get the cash you need as soon as possible.