Forex traders are always looking for new ways to gain an edge in the market. One popular strategy that many traders use is the Parabolic SAR and Moving Average strategy. In this article, we will discuss what the Parabolic SAR and Moving Average strategy is, how it works, and how it can be used to trade the forex market kpop pantip.

What is the Parabolic SAR and Moving Average Strategy?

The Parabolic SAR and Moving Average strategy is a technical analysis trading strategy that uses two indicators to identify potential trading opportunities in the forex market. The first indicator is the Parabolic SAR (Stop and Reverse) indicator, which helps to determine the direction of the trend monadesa. The second indicator is the Moving Average (MA) indicator, which helps to identify potential support and resistance levels.

The Parabolic SAR indicator is used to identify potential trend reversals. It is represented by a series of dots that appear above or below the price on a chart. When the dots are above the price, it indicates a downtrend, and when the dots are below the price, it indicates an uptrend timesofnewspaper.

The Moving Average indicator is used to identify potential support and resistance levels. It is calculated by taking the average price of a currency pair over a specific period of time. Traders often use different time periods for their Moving Averages, such as the 50-day or 200-day Moving Average.

How does the Parabolic SAR and Moving Average Strategy work?

The Parabolic SAR and Moving Average strategy works by using the Parabolic SAR indicator to identify the direction of the trend and the Moving Average indicator to identify potential support and resistance levels. The strategy involves buying or selling a currency pair when the Parabolic SAR and Moving Average indicators provide a signal newspaperworlds.

In an uptrend, the Parabolic SAR indicator appears below the price, and the Moving Average indicator acts as a support level. Traders can look for buying opportunities when the price pulls back to the Moving Average and the Parabolic SAR indicator remains below the price.

In a downtrend, the Parabolic SAR indicator appears above the price, and the Moving Average indicator acts as a resistance level. Traders can look for selling opportunities when the price rallies to the Moving Average and the Parabolic SAR indicator remains above the price.

When using the Parabolic SAR and Moving Average strategy, traders should use stop loss orders to limit their potential losses. Traders can place a stop loss order below the Moving Average when buying and above the Moving Average when selling Newsmartzone.

Example of the Parabolic SAR and Moving Average Strategy

Let’s take a look at an example of how the Parabolic SAR and Moving Average strategy can be used to trade the forex market.

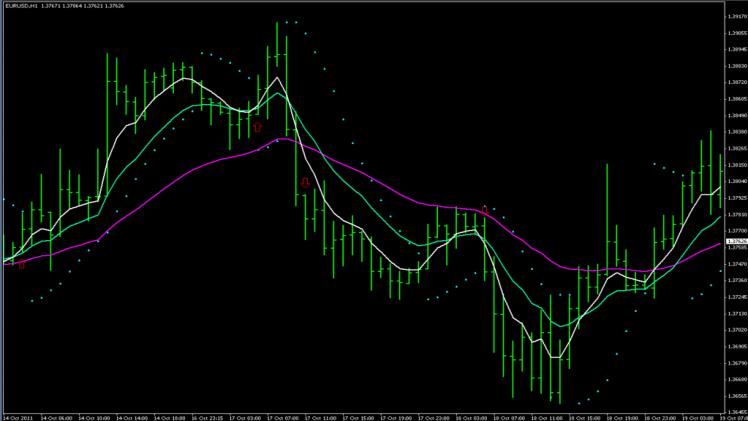

In this example, we will use the EUR/USD currency pair and a 50-day Moving Average. The Parabolic SAR indicator will have a step of 0.02 and a maximum value of 0.2.

The chart below shows the EUR/USD currency pair with the Parabolic SAR and Moving Average indicators applied.

As we can see from the chart, the Parabolic SAR indicator is below the price, indicating an uptrend. The Moving Average acts as a support level, and the price pulls back to the Moving Average several times.

Traders can look for buying opportunities when the price pulls back to the Moving Average and the Parabolic SAR indicator remains below the price. In this example, there are several opportunities to buy the EUR/USD currency pair when the price pulls back to the Moving Average.

Traders can place a stop loss order below the Moving Average to limit their potential losses. The stop loss order should be adjusted as the trade moves in the trader’s favor.

The Parabolic SAR and Moving Average strategy is a simple and effective trading strategy that can be used to trade the