The list of factors to take into consideration when choosing the right platform is long. This guide will save you both time and energy. Here’s a non-exclusive listing of Australian trading platforms traits we’ll examine throughout the guide:

- Markets and securities that are accessible: According to the kind of thing you wish to trade, you need to choose the right share trading platform. You might enjoy CFDs because they permit traders to trade virtually everything without having to invest in the purchase of the asset that is used to make the trade, or perhaps you prefer ETFs for investing into broad market indexes.

- Margin Accounts: Margin accounts lets you leverage to improve your return. Each one offers a certain amount of leverage that you can rely on in your transactions, and they are often described as a ratio. This is that each dollar you deposit into the account , you could get 20 or 15 dollars from your broker in order to increase the amount of money you can put into your position.

- Support: Customer support isn’t something you believe you require until you face problems. Because of this, the top companies provide top-quality customer support via chat to resolve any issue investors could encounter throughout their journey.

- Different types of order: The existence of different kinds of trade order is essential to ensure you are able to make money even when you’re not on the monitor. This includes trailing, stop-loss stops, and limit orders which can be very beneficial to investors.

- Security: Since there is the possibility of money, one of the main worries investors face is the security of their funds and personal information.

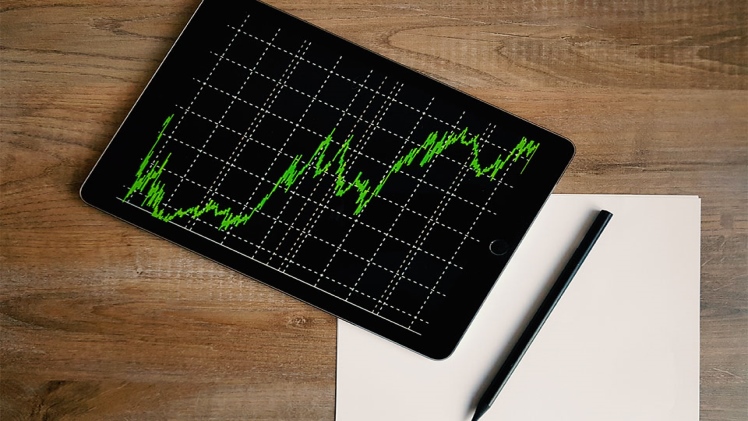

- Tools for research: You are likely not going to get up each day with one amazing trading strategy. That’s why tools for research are something to be looking for when choosing the share trading platform.

- Educational and training material: Trading is a process and not an event. Learning is a part of that process and your broker may help you in that regard by providing educational materials you can use to enhance your knowledge and increase your profits.

- Price of trading: The trading platforms have various ways of charging trading online using their systems. It is essential to understand what you’ll be paying to purchase shares or to sell them prior to pulling the trigger.

- Interface and its ease of use: Although the top providers provide mobile apps as well as user-friendly desktop interfaces, there are distinct elements that all their systems have that might be beneficial to some, while being uncomfortable for some. Because you’ll be working via these systems on a regular basis, you must ensure that you’re comfortable before you decide which broker you are going to sign up with.

Frequently Asked Questions

Which platform for trading is better: Saxo Bank or eToro?

To evaluate the trading for etoro vs saxo bank, we evaluated each broker’s trading equipment, tools for researching and mobile applications. When it comes to the tools for trading, Saxo Bank offers a superior experience. Through study, IG offers superior market research. We also discovered Saxo Bank to provide better mobile apps for trading.

What should I do to begin Forex Trading with?

It is recommended for new traders to test trading on an account with a demo account in order to understand the market and trade on the platform without losing money. In addition it is recommended to study the educational materials provided by the broker, and master trading fundamentals. You can then put down the minimum amount for a few transactions. If you are able to finish more than one month with a positive balance, and without large drawdowns on your account, you may consider increasing the amount you deposit. You can also try copying trades in a computerized fashion is an excellent idea to start.

What is the minimum amount I should start trading with?

A minimum deposit of $10 could be sufficient for trading on the Cent account. For trading on accounts that are Standard/ECT, experts suggest that you start with at minimum 200-500 dollars. In this range, you’ll be able to utilize a low leverage. Be aware that getting caught up by the margin is the most common reason for losses in beginners.