The home loan interest rate in Bangladesh is much higher than that of neighbouring countries. The lack of universal lending system and difficult mortgage conditions are making it difficult for Bangladeshis to buy affordable homes. Experts suggest the government introduce a logical home loan system based on the model used in developed countries. Insiders in the banking sector say there are several factors that affect the interest rate in Bangladesh. nupedia

Home loans are offered by financial institutions and last for a long time. They are generally high-cost loans, requiring long repayment schedules. They often require the borrower to pledge his or her home as security. If the borrower defaults on the loan, the lender has the right to sell 9xflixcom the home. The repayment period ranges from three to 25 years.

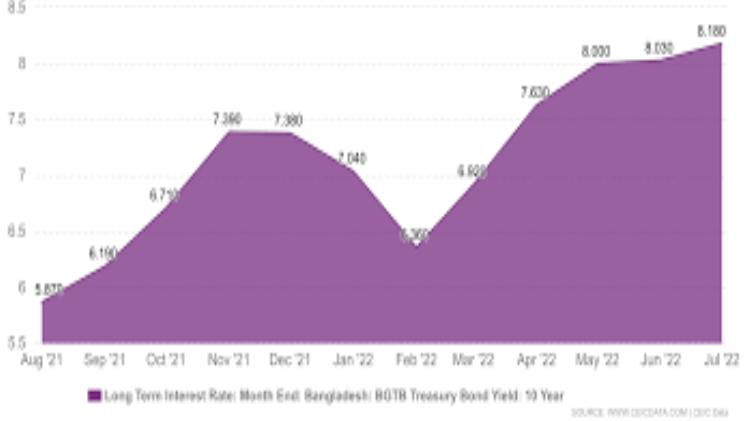

The home loan interest rate depends on the current lending rates of the infoworld bank. It is a percentage of the principal amount that the lender charges mezoka. This rate is often linked to the repo rate and may change. The markup rate is the small percentage that is added to the base rate, depending on the bank.

Bangladesh is currently home to only one dumporgovernment institution that offers home loans. The Bangladesh House Building Finance Corporation charges 8%-9% interest on its loans. The rest is charged by twenty-six private banks and non-bank financial institutions. In comparison to Bangladesh, the interest rate on home loans in India is six to eight percent p.a tinyzonetvto